Welke impact heeft de corona-crisis op de digitale sector? De resultaten van maart 2020.

1 april 2020

FeWeb lanceerde in maart 2020 een wekelijkse survey om de impact van de coronacrisis op de digitale bedrijven te meten. Dit artikel gaat dieper in op de resultaten van de eerste twee edities die op 20 en 27 maart 2020 verzameld werden. Dit onderzoek werd in samenwerking met FeWeb partner Sitemanager ontwikkeld.

These are the results of the FeWeb Corona Impact Barometer conducted between 27 and 31 March 2020. We counted 59 participants. We have compared these results with the results of the first edition conducted between 20 and 24 March 2020, where we counted 77 participants.

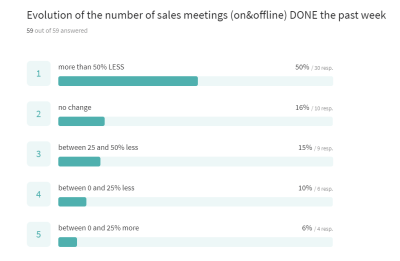

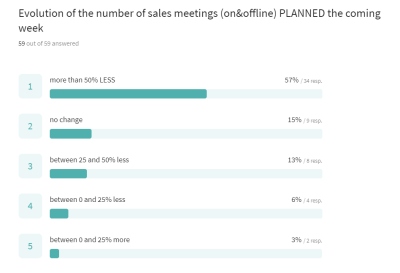

1. The sales meetings

|

|

We have asked the market about the number of sales meetings done during the past week and planned for the week to come. 3 out of 4 companies see a negative trend for sales meetings being done and planned.

When we compare the results of 27 March with the results of the week before, we do hardly see any difference between the two weeks as for the sales meetings done, but we can see that web & app companies as well as other digital service companies see a slightly larger drop in planned sales meetings than advertising & marketing companies.

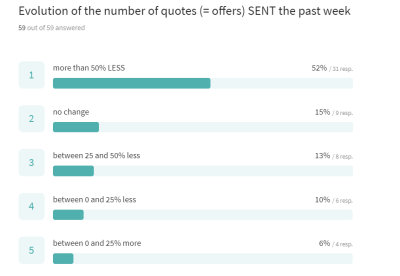

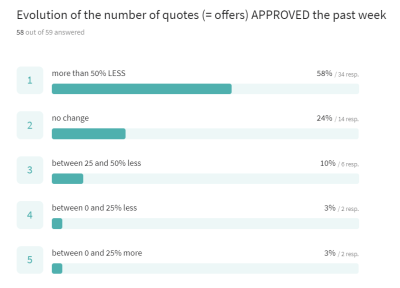

2. Offers sent & approved

|

|

Here also, 3 out of 4 companies see a negative trend in offers sent and approved.

Only for other digital services, we see a slight improvement as for offers sent, but a bit less offers are being approved. Marketing & advertising companies have had a less worse week than the week before (from 72% to 62% less offers approved), while the opposite is true for web & app Agencies (from 62 to 72%).

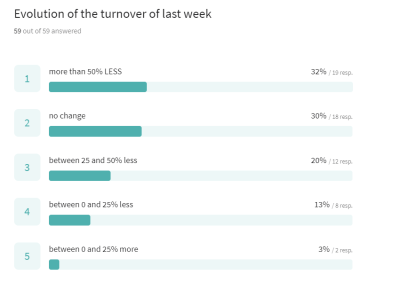

3. Turnover evolution

The turnover forecast was stable negative for all types of digital companies: 2 in 3 digital companies experienced a negative trend, but web & app agencies had a slightly worse week (from 60 to 69% less turnover).

|

4. Invoices & payment

67% of the invoices are paid within the payment period, compared to 72,5% the week before. We see a slight negative trend for marketing & advertising agencies (from 68 to 64%), but a very negative trend for other Digital Services (from 87 to 58%).

Have your clients asked for a later payment? 8,5% of the respondents said that clients have asked this. Web & app agencies lead with 10%.

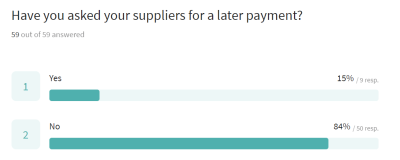

Only 15% have asked their suppliers for a later payment. 25% of the marketing & advertising agencies have asked their suppliers for a later payment.

|

5. Internal organisation & business continuity

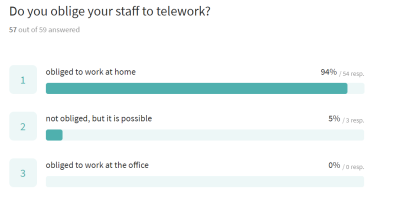

The majority of our digital companies have obliged their staff to work remotely. Some web & app agencies (6%) and digital services companies (9%) have not obliged people but offer the possibility.

|

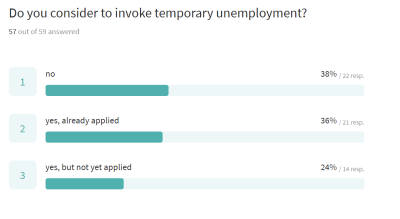

As for the possibility of temporary unemployment, we see a trend were more digital companies have actually implemented this. The first week we saw that only 18% had applied temporary unemployment. On the other hand, we see that companies who have not considered temporary unemployment in the first week have not changed their opinion in the second week.

|

|

As for asking staff to take holidays, more digital companies are considering this, but have not yet done so. In marketing & advertising agencies we see that 0% have actually asked it.

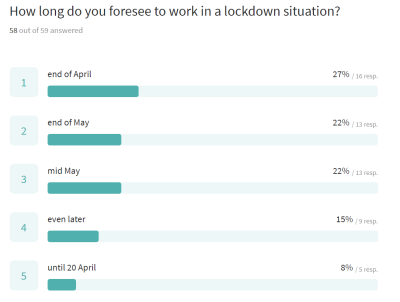

Most respondents think that at the end of April the lockdown will be over. The majority thinks that mid of May will be more realistic. In this respect, we see that marketing & advertising companies are the most optimistic (50% bets on end of April), while 47% of the web & app agencies bet on mid May and 50% of the digital services companies bet on end of May.

|

Sources:

- Results of 20 March 2020: https://feweb.typeform.com/report/Kzo4iV/HAoexPPLnz3wkYfJ

- Results of 27 March 2020: https://feweb.typeform.com/report/adruj6/IMY30aCH0IhdgmKM